0x07 An Inflexion Point

On the new US controls related to semiconductors on Chinese entities

Last week, the Bureau of Industry and Security (BIS) announced the much-anticipated unilateral controls by the US on China’s semiconductor industry. I consider this move a significant geopolitical and geoeconomic milestone for three reasons in this Twitter thread.

This CNBC story by the excellent Arjun Kharpal carries my quotes on this issue. Here’s the complete set of questions and my responses.

Q1: How far-reaching are the new U.S. rules in terms of restricting foreign (non-US/Chinese) business with China in high-end chips? What's changed?

There are significant changes in the breadth and depth of controls, both. By breadth, I mean that the controls have expanded to more Chinese companies, universities, and sectors. For instance, Chinese entities cannot access supercomputers or chips that go into them, including AI chips. Another target is semiconductor manufacturing equipment that can be used to produce chips that go into weaponry or products that enable human rights abuses.

By depth, I mean that the existing controls have got more restrictive than before. Earlier, companies were able to get export licenses readily. But the new controls make it difficult for companies to obtain licenses. By default, licenses will be denied unless companies can prove that their products will not be deployed for end-uses that are against the national security or foreign policy interests of the US. In short, the US has formally shifted its goal from outpacing China in the semiconductor industry to actively denying it access to advanced chips.

Q2: What are the main Chinese industries affected?

All sectors using advanced computing and AI chips will likely be affected. Autonomous mobility, high-end mobile phone makers, AI-based surveillance systems, and advanced defence weapons industries will have difficulty accessing US-made chip-making software and specialised chips. They will also find it challenging to access chips made by non-US companies which rely on US-made manufacturing equipment. Advanced computing research in universities will also be adversely affected.

Q3: Do you see any impact on Chinese electric car companies?

No significant, immediate impact on companies that make vehicles using batteries. But the restrictions on AI training chips will hit autonomously driven electric vehicles.

Q4: What implications does this have for the development of China's homegrown chip sector?

China's homegrown chip sector will be hobbled by these extensive controls. China's semiconductor industry will resort to industrial espionage and targeted poaching of talent in other companies with the aim of domestic substitution of all chip-making software and hardware. Semiconductor production is a hyper-globalised supply chain. Being cut off from this engine will mean that Chinese companies must "reinvent the wheel" domestically. China's semiconductor industry will need much higher capital and talent to absorb this shock.

Trying to reinvent the wheel will be much more difficult when the doors of other semiconductor powers are shut. Without ASML's EUV lithography equipment, China will still be able to manufacture advanced chips, but the yield will be far lower, meaning higher costs and lower reliability. China will have to rely on lower-end domestic alternatives for EDA tools. The restrictions on US persons working in China on advanced semiconductors are also a significant problem. Reinventing the wheel will be far more costly now.

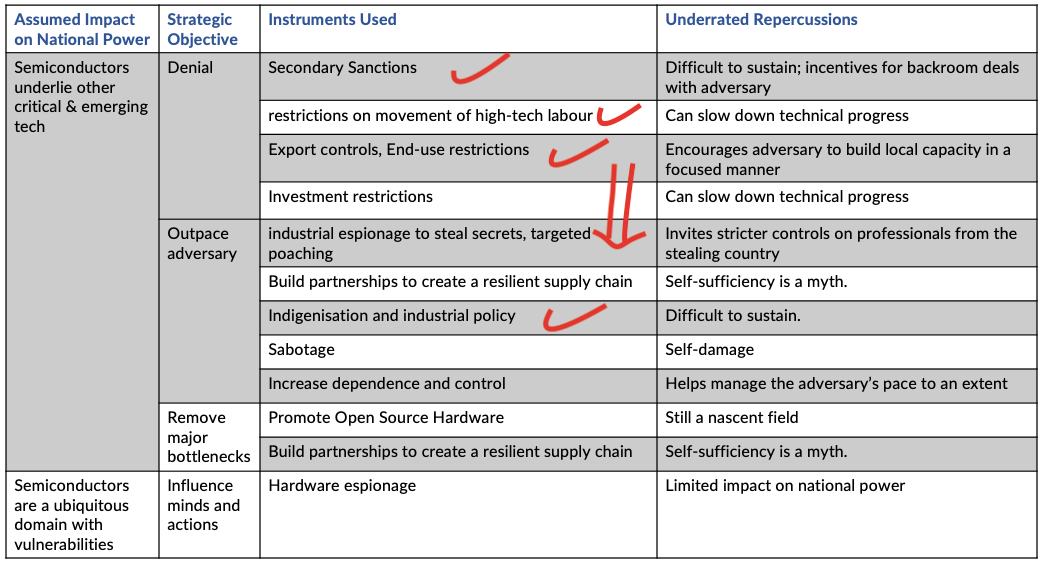

Tailpiece: Here’s where we are on the Silionpolitik Framework. The red tick mark indicates the controls that are already in action today. China's options are limited: industrial espionage, targeted poaching, domestic "reinventing the wheel", or a technological breakthrough that allows it to get around the restrictions.